Are you planning a vacation? If so, travel insurance is an important part of your trip. But how do you know which one to choose? There are many different travel insurance products out there and it can be hard to decide which plan is right for you. That’s why we have prepared an EKTA Travel Insurance review – so that you have the information you need to make an informed decision.

EKTA is easy-to-buy, and it is cheap – sounds good, right?

Continue reading, and, you’ll get all the facts on coverage and benefits, plus our opinion on whether or not EKTA travel insurance is worth the investment!

Buy EKTA travel insurance online!

Did you miss a connecting flight? File a compensation claim online.

1. What Is EKTA Travel Insurance and How Does It Work?

EKTA is a travel insurance company from Ukraine.

Their insurance covers all the usual things such as medical emergencies, trip cancellations, and lost or stolen luggage. With EKTA, you can customize your coverage to fit your individual needs and preferences. Whether you’re a frequent traveler or planning a one-time trip, EKTA has you covered. The process works by selecting the level of coverage you desire and applying online.

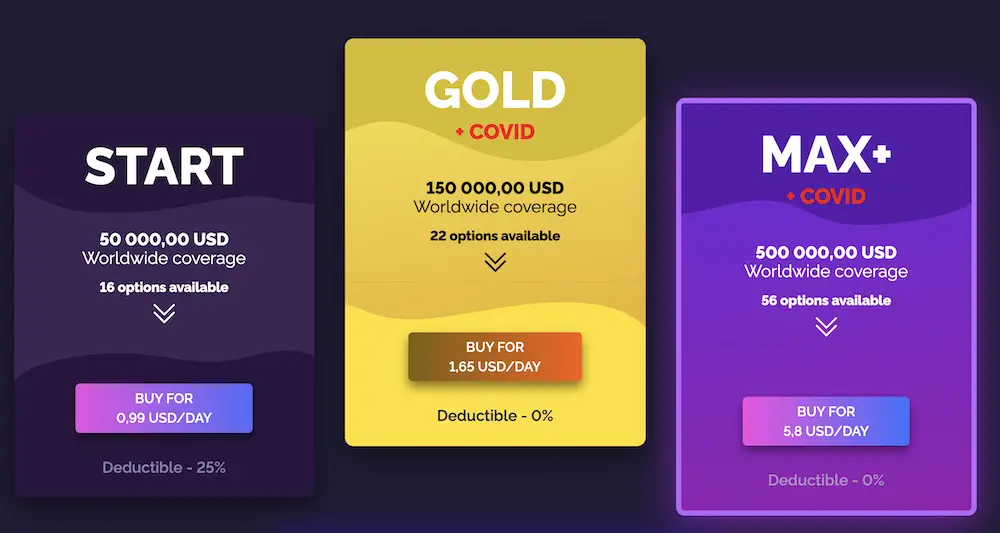

At the moment, there are 3 levels – Start, Gold, Max+.

One of the main differences between the Start (cheapest) and other levels are that with Start there is a 25% deductible. That means that if there is a medical emergency, and the bill is 2000 dollars, you will have to pay 500 dollars (25% of the 2000) and EKTA will pay the rest, as long as it falls under the policy. With Gold and Max+ there is no deductible.

You receive an insurance policy in your e-mail within 60 seconds after you make a payment.

2. What Does EKTA Cover?

EKTA Travel Insurance offers a wide range of coverage for travelers to ensure they have a worry-free journey. Same like many other travel insurance companies? Exactly. It covers more or less the same things like most.

The plans include emergency medical coverage, trip cancellation and interruption, baggage loss and delay, and more. The coverage varies depending on the insurance plan you have chosen. So, here, for example, are some of the things covered by the Gold plan:

- Medical assistance in connection with a sudden illness, injury, poisoning, or consequence of an accident;

- Medical services required for the treatment of COVID-19 and ARVI within the established limit of liability – 10,000 USD for one insured event and a sub-limit of no more than 5 (five) days of inpatient treatment or in the case of outpatient care – no more than 5 appointments with specialists;

- Emergency gynecological care during pregnancy, not exceeding 27 weeks;

- Emergency dental care, including a dental examination, x-ray examination, removal or filling of teeth with temporary fillings;

- Sunburns of the first and second stages;

- Damage to the part or all of the baggage;

- Loss of baggage.

See the full list of what EKTA travel insurance covers here.

Make sure to see the list of exceptions (Article 7, Exceptions).

Buy EKTA travel insurance online!

EKTA also offers 24/7 travel assistance to help travelers with any travel-related concerns they may have. You can contact them via Whatsapp, Telegram, Viber, e-mail, and you can also call them – whatever suits you the best. See their contacts on their website footer.

2.1 What EKTA Doesn’t Cover?

Here are some of these things:

- Treatment of chronic or congenital diseases;

- Oncological diseases, cirrhosis, chronic renal failure, systemic connective tissue diseases, autoimmune diseases;

- Consultations, examination, and treatment related to complications of pregnancy after 27 weeks of pregnancy;

- Purchase or repair of assistive devices (such as pacemakers, glasses, contact lenses, hearing aids, inhalers, prostheses, crutches, wheelchairs, measuring devices, etc.), hygiene products, baby food;

- Events that occurred during professional sports, active recreation, or work.

If you are an active traveler, take into account that by default EKTA doesn’t cover active recreation – it is available as extra.

For up to date information, check the current Public Agreement (link to the website of EKTA). This list may change or have changed already. And some of what was excluded previously may be covered now.

Buy EKTA travel insurance online!

3. Pros and Cons of EKTA Travel Insurance

Let’s start with the pros of EKTA insurance:

- It is cheap. EKTA is a cheap insurance. So, if you need a very cheap travel insurance, this is one of the best options. Sometimes, that’s exactly what you need – something that covers the basics.

- It covers all the basics. And it does it for less money than many other travel insurance providers. If you know what you need, and you see that EKTA covers all of that, it may be a great deal for you.

- It is very easy to buy EKTA. You can easily buy travel insurance online. Also, if you have already started a journey.

Cons:

- Start level (the cheapest) is limited. Plus, it comes with a 25% deductible. If something happens, you cover 25% of the expenses yourself. Don’t forget about this, when choosing the cheapest plan.

- The basic level doesn’t cover sports. By default EKTA doesn’t cover active recreation, let alone extreme sports like high-altitude hiking and mountaineering. If you are an active person, take this into account – the cheapest level of EKTA travel insurance won’t fit you. But you may be good if you add extreme sports.

Understand your needs. Read EKTA travel insurance reviews written by other travelers. And buy that insurance! If it fits your needs!

4. How Much Does EKTA Travel Insurance Cost?

EKTA travel insurace costs starting from 0,99 USD/day.

But the price varies, depending:

- on your age (price increases significantly once you are 60+),

- coverage options (with sports it’s about 3 times more expensive).

The price is the same for all countries worldwide.

And also with the Gold plan the price is very reasonable. It’s also worth noting that investing in travel insurance can save you a lot of money in the long run if something goes wrong during your travels. So, go to the website of EKTA, and get an instant quote (and get that insurance!).

There are countries where EKTA travel insurance doesn’t work. For example, at the moment this list include Russia and Belarus.

Buy EKTA travel insurance online!

5. How to Buy EKTA Travel Insurance?

To get started, simply visit the EKTA Travel Insurance website and explore the different plans available. Be sure to read the details carefully so that you understand exactly what is covered and what is not.

Once you have found a plan that fits your needs and budget, you can easily apply online and receive coverage instantly (in 60 seconds). With EKTA Travel Insurance, you can focus on enjoying your trip, knowing that you are protected.

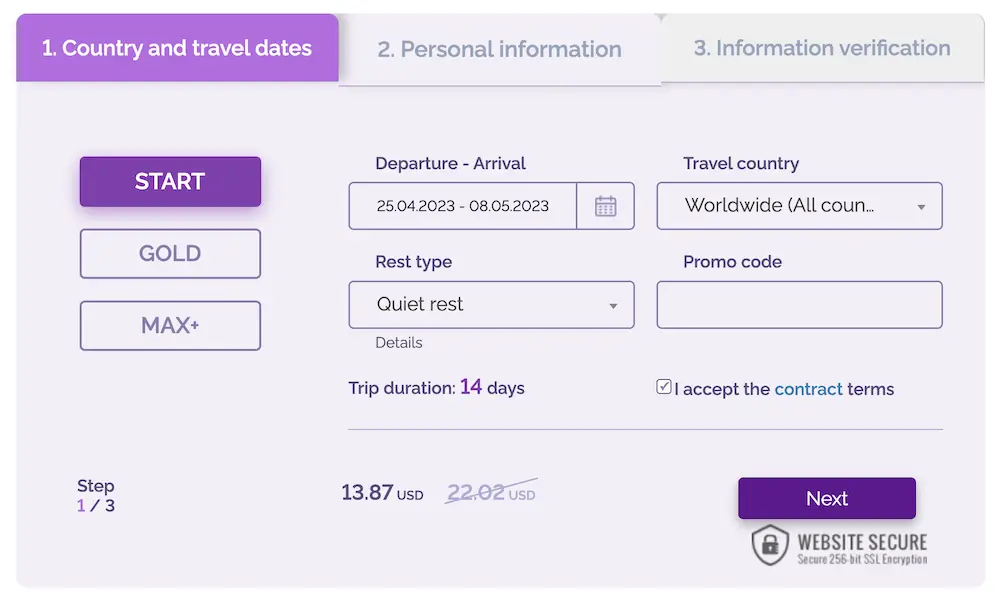

This is how it looks (it’s only 3 steps):

As you can see – 14-day worldwide coverage starts from 13,87 USD.

It is cheap! Super cheap!

Buy EKTA travel insurance online!

The Bottom Line

Ultimately, evaluating whether EKTA is right for you depends on factors such as your age, health and travel plans. If you are an active traveler, other insurance policies may be better for you. Or, if you are looking for more coverage than offered by EKTA. Other than that – if you need a cheap and reliable insurance, EKTA is a great option to consider.

As with every insurance policy, it’s essential to properly research your options and review the terms of the policy before purchasing travel insurance. By doing so you’ll find the best coverage that meets your budget and provides you with peace of mind while traveling.

About the author:

Kaspars is a digital nomad and travel blogger who’s been traveling the world extensively since 2013. Since 2017, Kaspars has been writing about the less-known aspects of air travel, things like air passenger rights laws and regulations. He’s really good at simplifying complex concepts and making them easily understandable. Kaspars favorite airlines are Qatar Airways and Turkish Airlines.